Are you feeling overwhelmed by the thought of organizing your financial records for tax purposes? Don’t worry; you’re not alone. Keeping track of your financial documents is crucial for staying compliant with tax laws and maximizing your deductions. Here’s a guide to help you understand the essential financial records you need to keep:

- Income Statements: This includes all sources of income such as wages, salaries, dividends, interest, rental income, and any other income streams. Make sure to retain documents like pay stubs, bank statements, and income summaries provided by clients or employers.

- Expense Receipts: Keep receipts for all deductible expenses related to your business or personal finances. This includes receipts for business expenses, home office expenses, travel, meals, charitable contributions, and more.

- Bank Statements: Maintain copies of bank statements for all your accounts, including checking, savings, and investment accounts. These statements serve as evidence of income, expenses, and transactions throughout the year.

- Credit Card Statements: Similar to bank statements, credit card statements provide a record of your expenses and can help you identify deductible items.

- Invoices and Contracts: Keep copies of invoices issued to clients or customers and contracts for services rendered. These documents can support your income and expense claims.

- Property Records: If you own property, retain documents related to its purchase, sale, or improvement. This includes settlement statements, purchase contracts, renovation receipts, and records of capital improvements.

- Vehicle Records: If you use your vehicle for business purposes, keep records of mileage, fuel expenses, maintenance, and repairs. This information is essential for calculating deductions related to vehicle expenses.

- Tax Forms and Filings: Keep copies of your filed tax returns, including supporting schedules and forms. These documents provide a historical record of your tax filings and can be useful for reference in future tax years.

- Retirement Account Statements: Maintain records of contributions, withdrawals, and transactions in your retirement accounts such as superannuation funds or SMSF’s.

- Insurance Documents: Retain records of insurance premiums paid, including health insurance, property insurance, and any other relevant policies. Certain insurance premiums may be deductible.

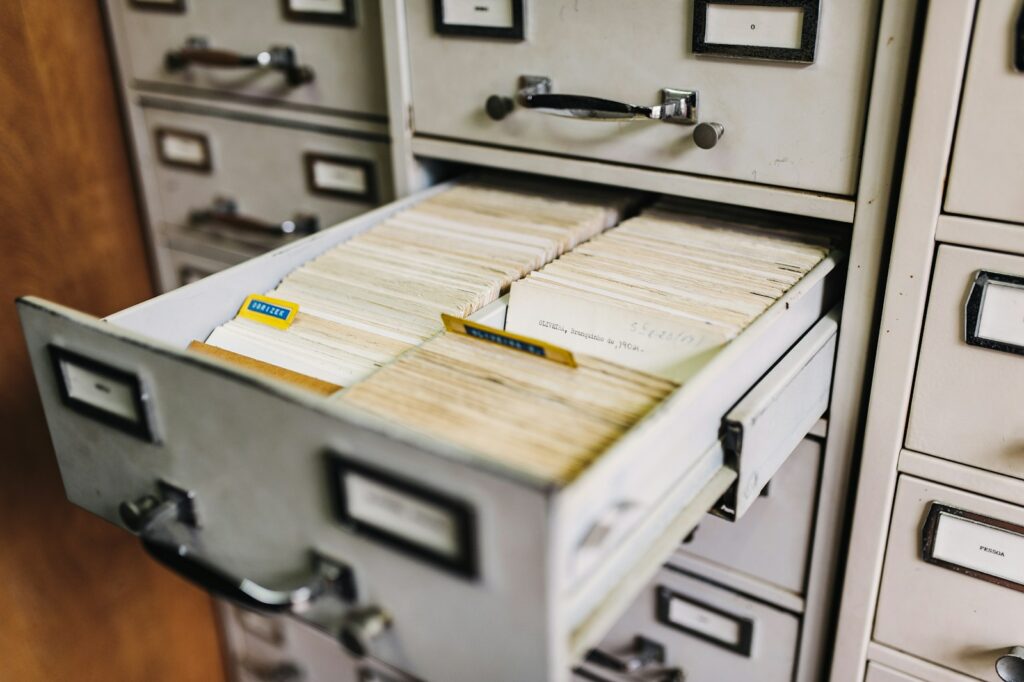

By keeping these financial records organized and readily accessible, you’ll be better prepared to file your taxes accurately and efficiently. Remember to store physical documents in a secure location and consider digitizing them for easy access and backup. If you’re unsure about which records to keep or need assistance with tax planning, consult with a qualified accountant or tax advisor who can provide personalised guidance tailored to your specific situation.